Computer depreciation life

Computer depreciation life gaap 15708 post-template-defaultsinglesingle-postpostid-15708single-format-standardbridge-core-280qodef-qi--no-touchqi-addons-for-elementor. The tax rules for treating computer software costs can be complex.

Straight Line Depreciation Formula Guide To Calculate Depreciation

Computer-to-plate CtP platesetters including thermal and visible-light platesetters and Direct-to-plate flexographic platesetters Computer digital imagers 5 years.

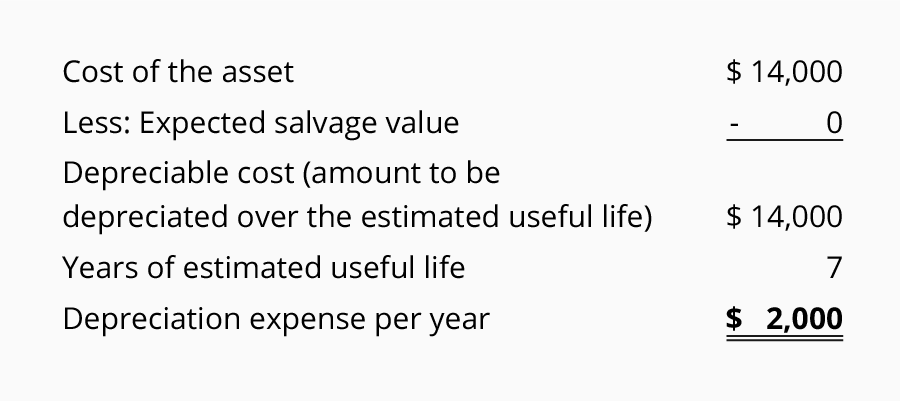

. Depreciation on computer hardware and software over 1 year possible BACKGROUND. The table specifies asset lives for property subject to depreciation under the general depreciation. Depreciation is the systematic allocation of the depreciable amount of an asset over its useful life.

The current Effective Life estimates for computers under Table B are. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674. The MACRS Asset Life table is derived from Revenue Procedure 87-56 1987-2 CB 674.

Using the Straight-Line method as prescribed by GAAP divide the cost 200000 by the useful life 20 years to determine the annual depreciable value of. During the 106th Congress some business groups tried to persuade Congress to change the depreciation schedule for computers and computer peripherals such as printers and. Computers effective life of 4 years Under the depreciation formula this converts to a Diminishing Value.

You would normally use MACRS GDS 5 year 200 declining balance to depreciate. Alternatively you can depreciate the acquisition cost over a 5-year. The table specifies asset lives for property subject to depreciation under the general depreciation.

The special depreciation allowance is 100 for qualified property acquired and placed in service after September 27 2017. You are right that computers are depreciated over 5 years. The depreciable amount of an asset is the cost of an asset or other amount substituted for.

DEPRECIATION FORMULA ACV RCV - DPR RCV AGE EQUATION VARIABLES ACV Actual Cash Value Depreciated Value AGE Age of Item Years RCV Replacement Cash. Mobileportable computers including laptop s tablets 2 years. Heres a basic overview to determine the tax treatment of the expenses.

Computers and computer equipment. Computer hardware and software are subject to increasingly rapid. From Jan 1 2021.

The cases in which the costs are. ADS is another option but.

/double-declining-balance-depreciation-method-4197537-FINAL-9baf4fb736b74a1686dd768332f364b3.png)

Double Declining Balance Ddb Depreciation Method Definition With Formula

How Long Does A Gaming Pc Last Statistics

Method To Get Straight Line Depreciation Formula Bench Accounting

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic

Depreciation Methods Principlesofaccounting Com

Depreciation Expense Double Entry Bookkeeping

Straight Line Depreciation Accountingcoach

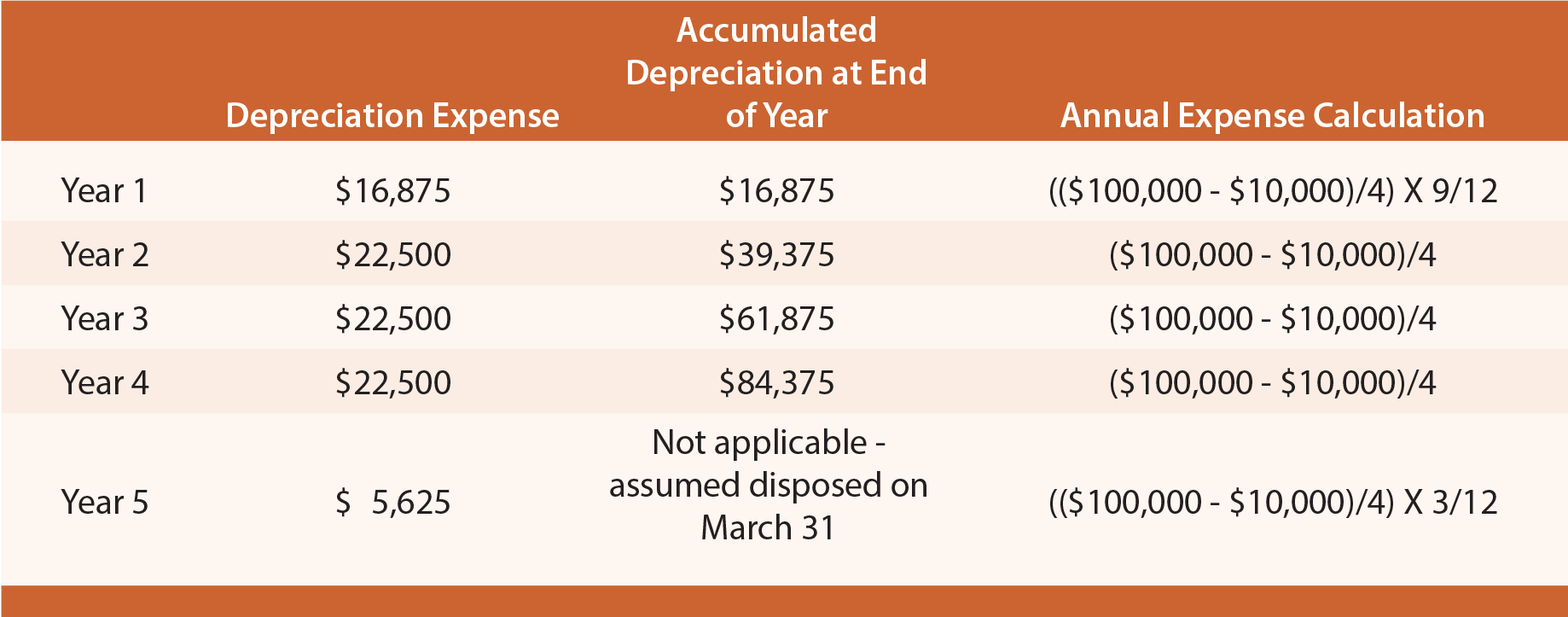

Depreciation On Equipment Definition Calculation Examples

Straight Line Depreciation Accountingcoach

How Long Does A Gaming Pc Last Statistics

Depreciation Rate Formula Examples How To Calculate

Straight Line Depreciation Accountingcoach

The Basics Of Computer Software Depreciation Common Questions Answered

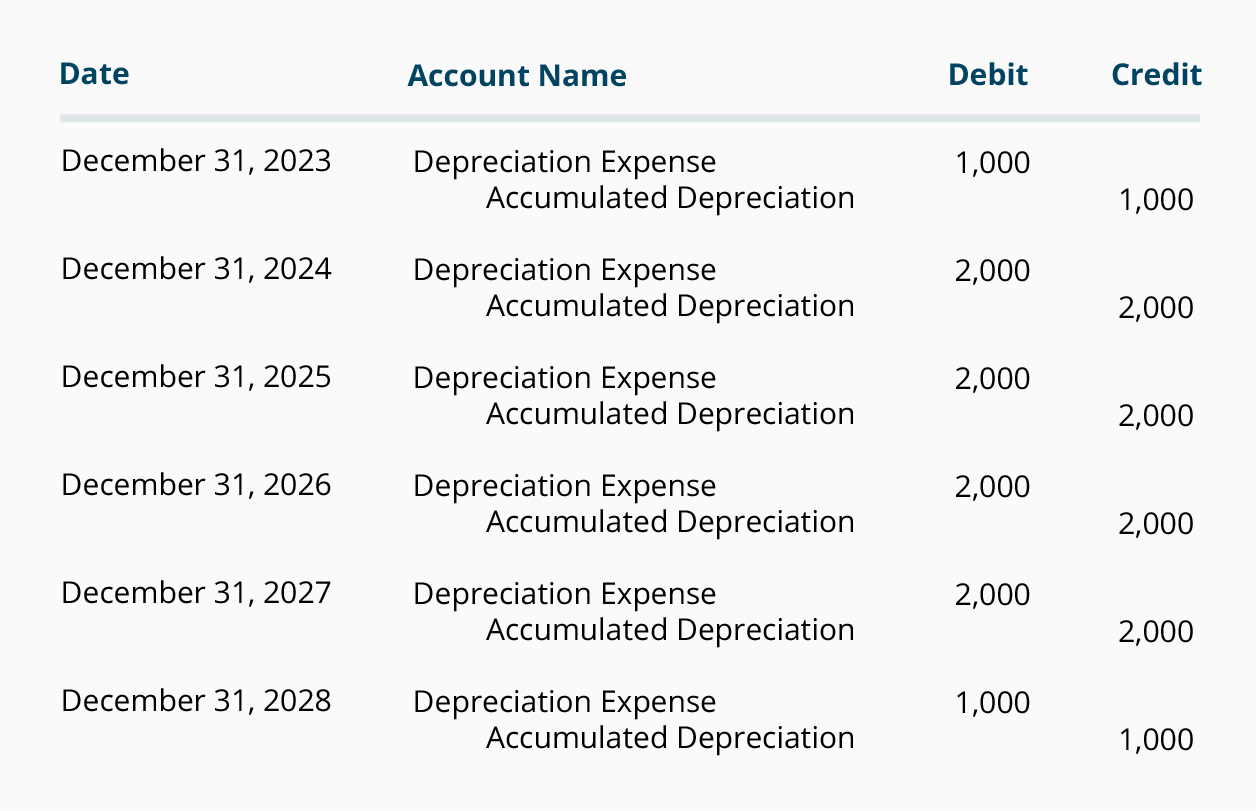

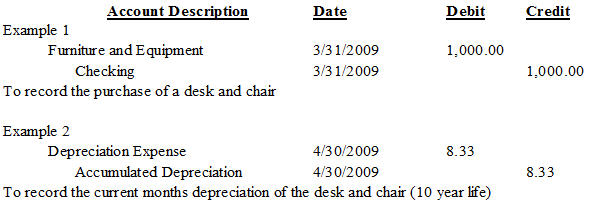

Depreciation Nonprofit Accounting Basics

Depreciation Rate Formula Examples How To Calculate

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)

Depreciation Definition

Projectmanagement Com What Is Depreciation